Last Updated on 13/04/2023

Investors may not agree on everything, but they do agree that a consistent plan built upon a set of rules is necessary for market success. If you’ve just started your path you probably entered the market with little expertise. Therefore, the greatest place to start if you don’t already have your own set of properly thought-out investment guidelines is by asking those who have succeeded in the field. We selected some tips from the top investors in the world to help you become a successful investor.

Who are the Top Investors in the World?

The most successful investors are great money managers. They have all amassed substantial fortunes from their ventures, and they have often assisted millions of others in achieving comparable profits to become the world’s top investors.

The most successful investors are great money managers. They have all amassed substantial fortunes from their ventures, and they have often assisted millions of others in achieving comparable profits to become the world’s top investors.

These investors’ trading approaches were very different; some came up with innovative and creative techniques to examine their investments, while others chose securities mainly on instinct. The one area where these investors are the same is in their capacity to routinely outperform the market. we have selected 5 of these financial world’s stars to benefit from their experiences and follow their successful paths.

Recommendation from the Top Investors in the World

Warren Buffett: Conduct the research and study the subject

Warren Edward Buffett is an American, investor, and philanthropist, He currently serves as Berkshire Hathaway’s chairman and CEO. Most people agree that Warren Buffett has been the world’s top investor in history. He is not only one of the wealthiest people in the world, but he has also influenced several presidents and world leaders financially. Markets around the world react to what Buffett says.

Buffett offers the following two recommendations when assessing a company: Consider the company’s quality before considering the cost. You must analyze financial statements, listen to conference calls, and interview management while evaluating a company’s quality. The price should only be considered when you are certain about the company’s caliber.

Bill Gross: Be persistent and believe in what you do

Bill Gross is a founding partner of PIMCO. Before resigning in 2014, he served as the company’s chief investment officer and oversaw the PIMCO Total Return Fund, one of the biggest bond funds in the world.

ThMost new investors are aware of the general concept of diversification, or the advice to avoid putting all e money into one company. Although it’s wise to diversify, doing so can reduce the profits if one of the picks makes a significant jump while other names don’t.

Taking risks based on a thorough study is another aspect of making money in the market according to the world’s top investors. It is preferable to always have some money on hand for prospects that require a bit more funding and not to be afraid to take action when you think your research is leading to a genuine winner.

Prince Ben Talal: Patience is the key to being among the world’s top investors

Prince Alwaleed Ben Talal is widely renowned in the world of investing. Saudi Arabian investors who established the Kingdom Holding Corporation later made a significant investment in Citicorp, the forerunner to Citigroup, in the early 1990s, growing to become the bank’s largest shareholder.

Moreover, he has made investments in Snap (SNAP) and Twitter. During the Great Recession, when several of his investments suffered losses, he had to exercise patience.

Prince Alwaleed Ben Talal held onto his investments when others sold, most notably when Citi was under intense pressure in the late 1990s. This is what many of the best investors do to build their wealth. Strongly committed investors who have done their research can ride out volatile market situations for extended periods.

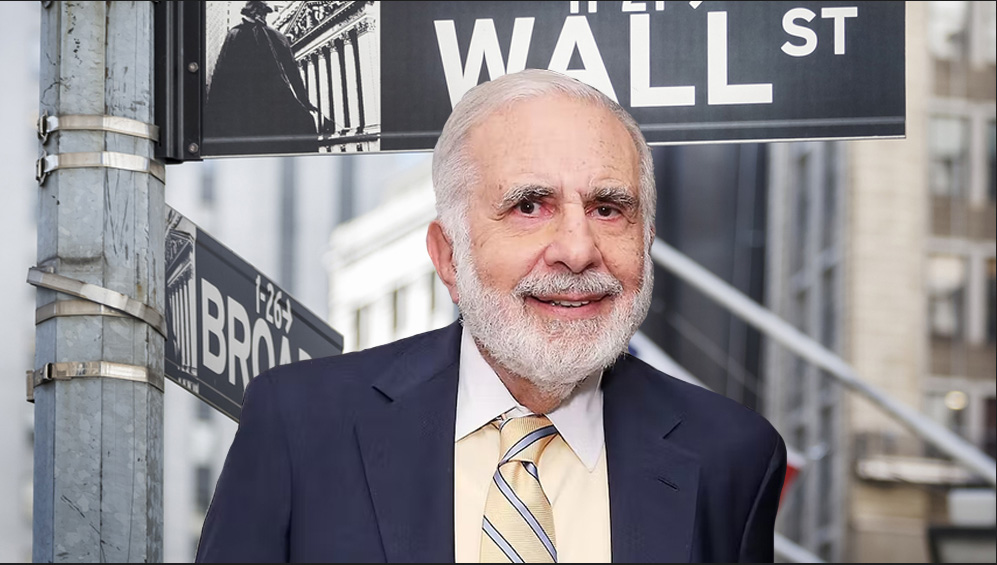

Carl Icahn: Be cautious

Carl Icahn is a corporate raider and activist investor who buys substantial shares in businesses to gain voting rights to boost shareholder value. Time Warner, Yahoo, Clorox, and Blockbuster Video were a few of his holdings.

Icahn’s most important investment advice is to avoid taking things personally. Investors shouldn’t entirely rely on Icahn’s counsel in terms of human interactions, even though he has amassed a good number of adversaries over the years.

There is only one piece of advice to follow: conduct thorough research on your own using facts, not opinions gathered from reliable sources. Additional advice can be taken into account and validated, but it shouldn’t be the only justification for making a financial commitment.

Carlos Slim: Aim forward

Carlos Slim is another of the richest individuals and the world’s top investors. He is the owner of hundreds of businesses and employs more than 250,000 people. He points out that tackling poverty in Mexico and South America presents one of the biggest prospects for investment

According to Slim, successful investors ignore the present to make decisions. Instead, they make investments for the future by analyzing a company’s or an economy’s momentum and how it interacts with its rivals. They constantly have the future in mind.

If you’re focusing on the present or attempting to join the bandwagon of an investment that has already generated short-term benefits, you most likely missed the big shift. Search for the next big winner, but keep your portfolio anchored with strong businesses that have a long history of consistent growth.

What to retain from top investors in the world

From successful investors and their experiences, there is much to retain. Each of these investors is renowned for being a leader and a market student. You should succeed in the market if you start using these guidelines and decide to stick to them regardless of what your mind tells you to do.

You can contact us through an initial free consultation for advisory and more investment information. Learn more about our services.